Spring Sale Limited Time 70% Discount Offer - Ends in 0d 00h 00m 00s - Coupon code = simple70

Pass the CIMA Strategic F3 Questions and answers with Dumpstech

A company's latest accounts show profit after tax of $20.0 million, after deducting interest of $5.0 million. The company expects earnings to grow at 5% per annum indefinitely.

The company has estimated its cost of equity at 12%, which is included in the company WACC of 10%.

Assuming that profit after tax is equivalent to cash flows, what is the value of the equity capital?

Give your answer to the nearest $ million.

$ ? million

A large, listed company in the food and household goods industry needs to raise $50 million for a period of up to 6 months.

It has an excellent credit rating and there is almost no risk of the company defaulting on the borrowings. The company already has a commercial paper programme in place and has a good relationship with its bank.

Which of the following is likely to be the most cost effective method of borrowing the money?

A company is considering whether to lease or buy an asset.

The following data applies:

• The bank will charge interest at 7.14% per annum

• The asset will cost $1 million

• Tax-allowable depreciation is available on a straight line basis over 5 years

• There is no residual value

• Corporate tax is paid at 30% in the year when the profit is earned

What is the NPV of the buy option?

Give your answer to the nearest $000.

$ ?

For which THREE of the following risk categories does IFRS 7 require sensitivity analysis?

ADC is planning to acquire DEF in order to benefit from the expertise of DEF's owner ‘managers Both are Listed companies. ADC is trying to decide whether to offer cash or shares in consideration for DEF's shares.

Which THREE of the following are advantages to ABC of offering shares to acquire CEF?

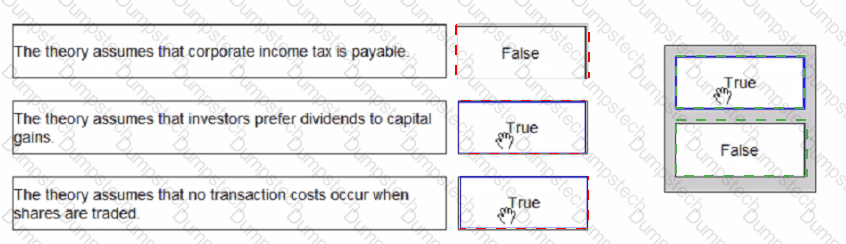

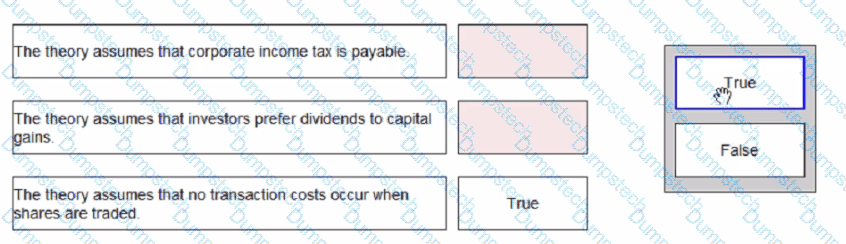

Select whether the following statements are true or false with regard to Modigliani and Miller's dividend policy theory.

The primary objective of a public sector entity is to ensure value for money is generated.

Value for money is defined as performing an activity so as to simultaneously achieve economy, efficiency and effectiveness

Efficiency is defined as:

A company is considering hedging the interest rate risk on a 3-year floating rate borrowing linked to the 12-month risk-free rate.

If the 12-month risk-free rate for the next three years is 2%, 3% and 4%, which of the following alternatives would result in the lowest average finance cost for the company over the three years?

Formed in 2010, the International Integrated Reporting Council The primary purpose of the IIRC's framework is to help enable an organisation to communicate which of the following'?

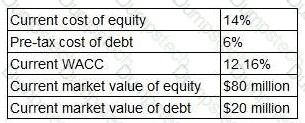

TTT pic is a listed company. The following information is relevant:

TTT pic's board is considering issuing new 6% irredeemable debt to re-purchase equity. This is expected to change TTT pic's debt to equity mix to 40: 60 by market value. The corporate tax rate is 20%.

What will be TTT pic's WACC following this change in capital structure?